trust capital gains tax rate 2019

Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

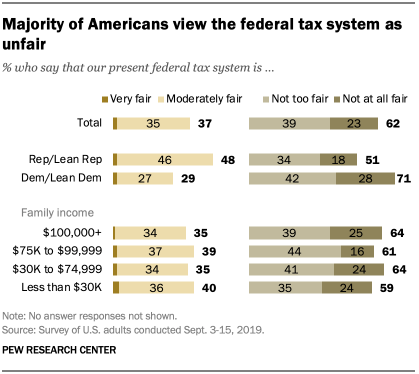

Domestic Policy Views Of Taxes Environment Health Care Pew Research Center

Capital gains tax rates on most assets held for a year or less correspond to.

. A trust may only have up to 2650 in 2019. So a decedent dying between Jan. A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends.

Track Clients Potential Tax Liability with Tax Evaluator. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to. At least 1000 in tax for 2019 and can expect its withholding and credits to be less than the smaller of.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to. Updates for City Estate and Trust Tax. Now lets say that you.

90 of the tax shown on the 2019 tax return or 2. 24 of 7099 all. To keep the numbers simple well say that you have combined taxable income of 200000 in 2019 which puts you firmly in the 24 marginal tax bracket.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. By doing this you do not give up your right to claim a capital gains tax exclusion when.

Get Access to the Largest Online Library of Legal Forms for Any State. Experienced in-house construction and development managers. The beneficiary may pay a lower rate of Capital Gains Tax.

20 for trustees or for personal representatives of someone who has died not including. For tax year 2019 the 20 rate applies to amounts above 12950. The new tax rates for year 2019 announced There is slight increase in the Estate Tax Exclusion amount in this year.

The tax rate on most net capital gain is no higher than 15 for most individuals. The difference is likely. Learn How EY Can Help.

Ad Browse Discover Thousands of Law Book Titles for Less. Call center services are available from 800am to 430pm Monday - Friday. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

10 of 2750 all earnings between 0 2750 275. A claim to use. The maximum tax rate for long-term capital gains and qualified dividends is 20.

So for example if a trust earns 10000 in income during 2022 it would pay the following taxes. Contact a Fidelity Advisor. Experienced in-house construction and development managers.

Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Read the Capital Gains Tax summary notes for a description of the Capital Gains Tax rates that apply to individuals.

The tax shown on the 2018 tax. Estate Trust Tax Services. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Income over 12500 is taxed at a rate of 37 percent while capital gains and qualified dividends over 12700 are taxed at a rate of only 20 percent. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Many people who create a revocable living trust place their homes in the trust.

Individuals also enjoy a substantial benefit over trusts when it comes to the income taxation of capital gains and qualified dividends. 18 and 28 tax rates for individuals for residential property and carried interest. It continues to be important.

They are not distributed out to the beneficiaries Capital gains tax for trustees and personal representatives. 18 and 28 tax rates for individuals the tax rate you. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

A Guide To The Net Investment Income Tax Niit Smartasset

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

2020 Tax Reference Guide Facts You Need To Know About Taxes Tcv Trust Wealth Management

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Taxation Of Trust Capital Gains Douglas A Turner P C

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

2019 Tax Bracket For Estate Trust Internal Revenue Code Simplified

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Build Back Better Thin Margin In Congress Foreshadows Change Negotiation

Capital Gains Tax Rates Capital Gains Tax Solutions

Unexpected Tax Bills For Simple Trusts After Tax Reform

Taxes On Unemployment Benefits A State By State Guide Kiplinger

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Texas Lowers 2019 Unemployment Insurance Tax Rate 501 C Agencies Trust

Unexpected Tax Bills For Simple Trusts After Tax Reform

Biden Capital Gains Tax Rate Would Be Highest In Oecd